Separation of Duties

I want to create a system of financial checks and balances...

What is it?

Separation of duties (also known as segregation of duties) is a measure that is put in place to ensure that no one person has responsibility for ALL of the financial duties related to an activity or process. Sharing these responsibilities between several individuals is an important internal control that is intended to safeguard team members and to prevent fraud and financial errors.

How do I use it?

Imagine a scenario in which a team member is authorized to manage ALL of the financial transactions of a project. This person writes the checks, purchases all of the materials and equipment, manages the bank account, approves financial reports and manages all the project stocks and inventory.

This might seem efficient because it reduces the number of people needed to manage financial operations and this one person has all the information they need at their fingertips. But it’s high risk. This person can make mistakes and they may not be spotted. Also they will have every opportunity to misuse resources because there are no checks and balances built in to prevent fraud.

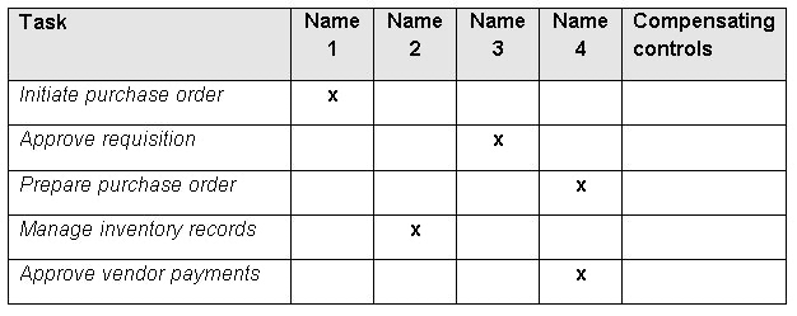

Responsibility for undertaking financial processes needs to be shared – with no employee having responsibilities for a whole process alone. This protects everyone in a team and removes the temptation to misuse funds. The separation of duties matrix helps a team to structure this approach. The example below is related to purchasing but can also be applied to cash management, petty cash, payroll, inventory, fixed assets and keeping accounting records.

Amira, Project Manager of the UNITAS capacity building project, is considering separation of duties as she builds her team. She needs to establish effective internal control, ideally ensuring that at least two people are involved in each financial process.

- Cash management – one person opens the envelopes containing checks from trainees attending the courses and a different person records these in the accounting records.

- Financial reporting – one person records financial transactions into the accounting records and a separate person reviews and approves the financial reports.

- Purchasing – one person places orders to buy goods and equipment and another person prepares the payment and records it in the accounting records.

- Inventory – one person looks after the stores and record all goods received and issued into an inventory register and another person counts this inventory from time to time and checks that the quantities counted agree to the register.

When do I use it?

The concept of separation of duties is introduced during the initial stages of a project, when assigning different areas of responsibility, developing job descriptions and hiring staff. Once a project moves into implementation, everyone in the team must understand their responsibility for financial duties, and the reason why checks and balances are built in. As the project evolves, it is important for the Project Manager to reconsider the separation of duties as part of reviewing the internal control system used by the project, as the team grows and implementation plans adapt and change, further separation of duties between more team members may be required.

Who is involved?

Everyone in an organization should understand the principle of separation of duties and be clear about how that is implemented for different financial processes. Managers are ultimately accountable for assigning responsibilities and ensuring that adequate separation of duties is built into the delegation of tasks. Project team members are responsible to implement their responsibility for financial tasks and ensure adequate separation of duties even when colleagues are absent.

Tips:

Separation of duties is particularly important in certain high-risk areas of financial management, for example cash and safe management, stocks and procurement. Always ensure that separation of duties is maintained even when staff are absent, by delegating authority to deputy staff, or introduce additional compensating controls.

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.