Income and Expenditure Budget

I want to plan the income and expenditures of my project...

What is it?

An income and expenditure budget for a project (or a program, or a whole organization), will show: the anticipated costs (expenditure), and funding (income) to cover those costs, for a specified period of time. You are probably already familiar with this type of budget as it is widely used in project management.

The overall position of an income and expenditure budget may be:

- Balanced – where income equals expenditure

- Deficit – where income is less than expenditure – and extra funds may need to be raised or costs cut

- Surplus budget – where income is more than expenditure – and action may be needed to plan how the additional income will be used.

How do I use it?

The following scenario from UNITAS explains how the income and expenditure budget is used in its Capacity Building Project.

Amira the project manager for the Capacity Building Project downloads the income and expenditure budget template and uses it to show the expected costs for her project’s planned activities. She uses UNITAS’s chart of accounts to assign an account code to each budget line code and description.

Amira has used an activity based budgeting approach to build the budget. This approach is appropriate for the project because it is just starting. She likes this budgeting approach because it is more accurate, and the project funders sometimes ask for detail of how the costs for each activity have been estimated. The funder approves her budget and agree to give her the money she needs to cover the planned expenditure. She can now include this expected income in the income and expenditure budget template.

When the project implementation starts, Amira will use her income and expenditure budget to make decisions about spending money on different activities. Before she approves expenditure, she will check if there is enough money in her budget. The budget will also be shown in reports she receives from the finance team. She will monitor the project actual expenditure against what was estimated in the budget each month. This helps Amira and her team identify any differences in good time and take action to keep the project on track.

When do I use it?

Income and Expenditure budgets are used extensively through the project life cycle:

Project Planning – the Income and Expenditure budget is a foundation document for project planning, identifying the project resource requirements, anticipated costs and funding. All budget lines are coded using the organization’s chart of accounts. Budgets are used to build an accurate picture of what an organization or a new project will cost to run and to help raise funds.

Project Implementation – once the project is approved, the budget and associated codes are used to ensure that costs are accurately recorded in the books of account. The budget guides decision making when allocating financial resources. It gives an overview of the income targets and limits on spending so the team is clear how much money is available for each part of the project implementation.

Project Monitoring – it is essential to have information on your project’s financial situation to manage it effectively. Budget monitoring reports help us to assess the project’s performance compared to the plan (budget). Action may be needed to get things back on track if we are spending more or less than the budget.

Who is involved?

The project income and expenditure budget is developed by the project team, members of the project team are in the best position to produce accurate and complete budgets for the projects they work on. They understand its objectives, the resources needed and the likely timing of activities. The finance team provides technical support to the process, designing templates, advising on pricing, exchange rates, shared costs and finance team members can help with financial data from previous projects or periods.

It is important that there is good collaboration between the project team and the finance team when preparing, monitoring and updating budgets.

Tips:

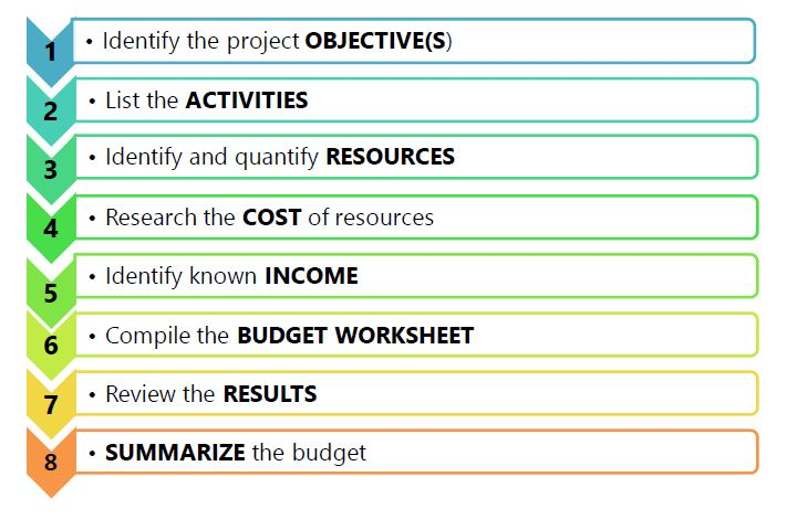

It is important to be well organized when developing an activity based income and expenditure budget for your project. Before you start, get together the following:

- project activity plans

- organizational guidance, eg on budgeting for salaries, indirect costs and inflation rates

- price list for commonly used resources

- budget worksheets and templates

- the chart of accounts.

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.