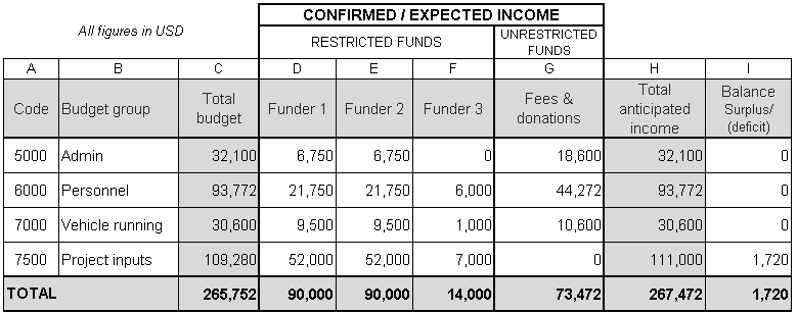

Funding Grid

I want to match income sources with project activities...

What is it?

Projects and programs often have more than one funder or source of income. While it is an advantage to have a diversity of funding sources, this also adds complexity to the financial management of these projects and programs.

The funding grid is an internal planning tool that gives you an overview of who is funding what at the project, program or organizational level. It is a table which shows the total budgeted expenditure for the project and what elements of the project activities and expenditure are covered by each funding source. This reveals where there are gaps in funding or any double funding by budget line.

If you are managing a project with multiple funders, it’s important to know which parts of your budget are fully funded (and which are not). It is a useful tool for fundraising as it sets out clearly who is funding what and identifies where additional funding is needed to ensure the project can be delivered.

Some funders will finance a fair share of indirect (core or support costs) and others don’t. So, the funding grid helps show if indirect costs are being fully funded and if the project or organizational targets are being met.

How do I use it?

The following scenario from UNITAS describes how the Funding Grid is used in its Capacity Building Project.

Amira from UNITAS needs to know how each part of her project is funded. She wants to check that all project activities are covered and that none have been double funded. She must also follow the rules and interests of each funder. So she puts together a funding grid!

First she opens her funding grid template (often set up in a spreadsheet). Starting with the contents of her income and expenditure budget, she enters each account code from her project budget into the left hand column (A) and the budget code description into the next column (B). In the third column (C), she enters the total budget for each of her budget groups. Amira allocates one column to each of her four funding sources and enters in the amounts they are contributing to each budget heading (columns D to G). Then she calculates the total of all four funding sources and enters it in column H showing the total anticipated income for each budget group. The final column, compares the total funding (H) with the total budget (C) and column I shows the balance – either fully funded, surplus or deficit. Amira works systematically through the template comparing the budgeted cost of activities against the total anticipated income.

The only area of concern she sees is that the project inputs are double-funded by USD1,720. She has more money than she needs to cover the costs in her budget. She makes a note to discuss this with the project team and make a plan for how this money might be used. She will also have to go back to her funders to discuss reallocation of this double funding with them.

When do I use it?

Funding grids are usually developed during the planning phase of a project and are referred to and updated throughout the implementation and monitoring of the project.

It is important that projects need to adapt to dynamic environments. Your project may continue for several years, with new funders coming on board and potential budget changes to reflect revised activity plans. So, it’s important to view your funding grid as a ‘living’ tool, that is also updated and amended regularly, as your fundraising situation evolves.

Who is involved?

Funding grids are usually developed and owned by the project manager in collaboration with the finance team. They are extremely valuable for fundraising and communication with funders, providing a professional, clear and transparent overview of the project’s finances.

Tips:

Here are some helpful tips for building your funding grid:

Funders will pay grants in different currencies. The currency that you choose for the funding grid may be your local currency or the currency of the main source of income.

Watch out for budget lines that are double funded. This is when money for the same item is coming from two or more sources. If this happens, you will need to speak to your funders to resolve this.

Make sure that your anticipated income and expenditure budgets cover the same time period. Funder agreements can start at different times (and will rarely coincide with your own planning year). The funding grid can be prepared to cover any time period which makes sense (eg the project period) but make sure your income and expenditure figures cover the same period.

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.