Chart of Accounts

I want to classify financial transactions...

What is it?

Projects need financial resources (money) to implement activities. The financial transactions for project implementation fall into two main categories:

- EXPENDITURES- spending money to buy a wide range of goods and services – from paying rent for an office to purchasing tools for a garden project.

- INCOME- receiving funds from grants, donations and membership fees.

To help manage projects, teams need to classify or ‘sort’ the different types of expenditures and income into pre-determined descriptive categories or accounts.

That is where the chart of accounts comes in. It is, quite simply, a list of categories that enables you to classify and sort financial transactions.

Most organizations will already have their own coding system in place where each category of INCOME and EXPENDITURE is attached to a specific account code. You should use and apply these codes to correctly record transactions in the accounting records and create financial reports.

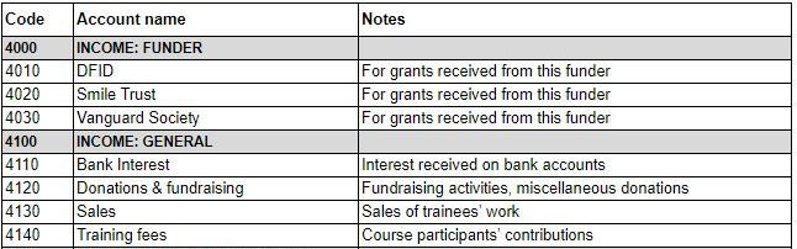

Here is an example of the INCOME section of a chart of accounts:

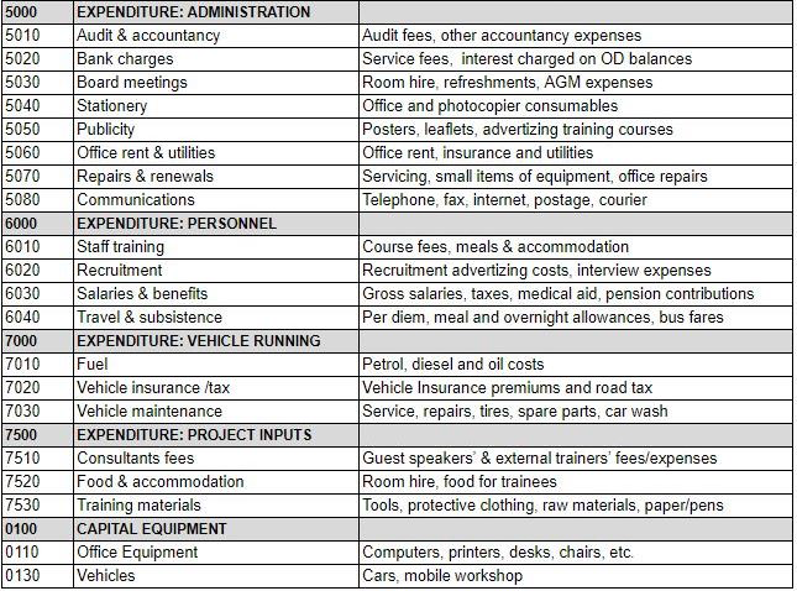

And this is an example of the EXPENDITURE section:

How do I use it?

The chart of accounts (translated literally as ‘list of categories’) is used by the project team during planning, implementation, monitoring and review of a project.

Illustrative use of the Chart of Accounts

Amira works for UNITAS and uses the organization’s chart of accounts through all phases of the project.

- Planning: When creating the project budget, all budget line items are assigned to a code from UNITAS’ chart of accounts. The project budget is input in UNITAS’ financial system using these codes. It is then easy for UNITAS to develop a budget for the whole organization summarizing all project budgets including Amira’s, because they all use the same coding structure.

- Implementation: Now that the project has been given the ‘green light’, Amira and her team need to use the correct account codes to record all project expenses and receipts. This makes sure that transactions can be tracked and linked to the project budget.

- Monitoring: Amira will use financial and management reports telling her about the financial status of the project. It is important that the team consistently use the correct account codes, so that the data in these reports is accurate.

When do I use it?

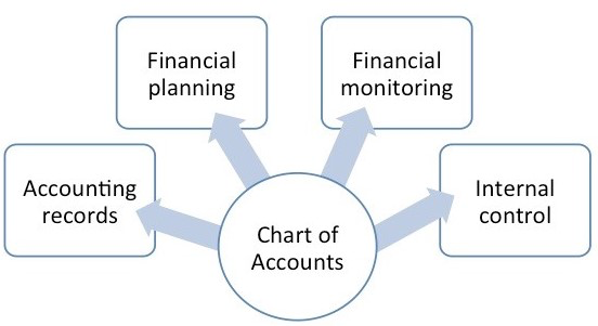

The Chart of Accounts is one of the most important organizing tools in accounting and financial management. The coding structure plays a role in all four of the building blocks.

The Chart of Accounts is used to:

- Summarize budgets using standard and consistent descriptions

- Classify financial transactions in the financial accounting records

- Check accounting records for consistency and accuracy

- Create management accounts and reports.

Who is involved?

It is important that everyone in an organization understands and uses the same chart of accounts, this ensures consistency in tracking financial information across the organization, and helps us compare financial data from one period to another or between projects, departments or locations.

All project staff who manage budgets or implement activities should have a copy of the chart of accounts for their organization, so that they can use the correct accounts codes when developing budgets or preparing supporting documents.Tips:

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.