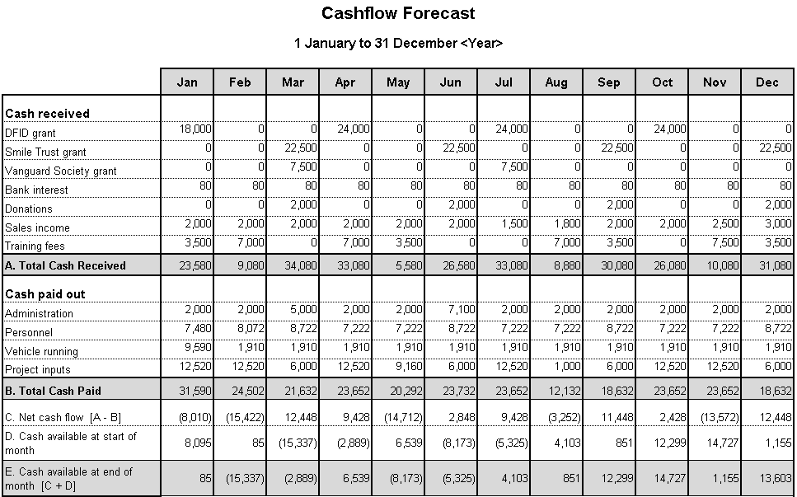

Cash Flow Forecast

I want to predict cash shortages and surpluses...

What is it?

The cash flow forecast is a financial planning tool that shows the predicted flow of cash in and out of a project or organization each month. Forecasting will enable you to plan ahead so that you can anticipate periods of cash shortage and take corrective action.

The cash flow forecast shows a month by month breakdown of the cash that we expect to receive and pay out for a project over a time period. The difference between the cash in and out of an organization each month is called the net cash flow.If we include the cash balance for the start of the project in the table, we can calculate (forecast) how much cash will be available at the end of a period. The balance for each month is shown as a total surplus or deficit at the bottom of the table for each month. This information will highlight any predicted periods of cash shortage and the project and finance teams can then work together to find solutions for the project.

How do I use it?

The following scenario from UNITAS demonstrates how the Cash Flow Forecast is used in its Capacity Building Project.

The UNITAS Capacity Building Project has started. The project funder has paid the first amount of money to the project and the project team has begun purchasing goods and services. To ensure that the project has the money it needs, when it needs it, Amira, the project manager, puts together a cash flow forecast and immediately spots a problem. A number of activities and expenses are planned for the month of May but the project will not have sufficient cash in the bank to pay for them until June. Now Amira needs to make some quick decisions to ensure that activities can progress as planned.

Amira has several options:

- She could go back to her funder to request that cash is provided earlier or on a schedule that better matches her activity plan.

- She could agree with the finance team that they will negotiate delayed payment of some big supplier invoices.

- She could reschedule training activities to better fit the funding timeline.

- She doesn’t want to seek a temporary loan from a bank, as this is expensive.

When do I use it?

It is important to do a cash flow forecast as part of the planning before a project begins. Project teams need to be confident they have sufficient cash to buy goods and services when needed to implement activities. Where problems are identified before a project begins, it is easier to discuss these with funders and negotiate a different payment schedule to be included in the funding agreement.

Project activity plans are dynamic and will usually need to adjust and change during project implementation. To ensure that unexpected cash flow problems do not arise, it is important to keep the cash flow forecast up to date. To avoid the cash deficit problem that Amira from UNITAS faced, you should revise your cash flow forecast every month. This will ensure that you are always in control of your project’s cash flow, and can identify problems early enough to find solutions in time.

Forecasts are especially relevant and helpful in cases where funders choose to pay grants in arrears, and require an organization to pre-finance project activities (i.e. pay for project activities up-front and get reimbursed later). They are also vital during a humanitarian emergency, when they may need to be updated on a weekly basis.

Who is involved?

The Project Manager is usually responsible for the forecasting, but when projects are large or more complex this task may be delegated to another member of the project team. Whoever is involved from the project team, they will need to collaborate closely with the finance team, who have overall cash management responsibility. Together they will ensure any problems are spotted early and agree appropriate actions to resolve any periods of predicted cash shortages.

Tips:

To develop your cash flow forecast you will need your income and expenditure budget, activity plans, income schedules and the capital budget (if you are using one). Then, download the cash flow forecast template. As you start to develop your forecast, keep the following in mind:

- Use your income schedule and funder agreements to predict expected cash receipts, and enter them in the months when you will receive them.

- Use your activity plan to work out when the cash to pay for expenditure will leave the bank. For unpredictable expenses – e.g. equipment repairs – estimate a monthly or quarterly average.

- Don’t forget to take account of payment terms for on-going expenses. For example office rent is paid quarterly in advance, so the rent for April to June would be paid on 1 April or even in March.

- Don’t include non-cash transactions (such as donations in-kind and depreciation) in the cash flow forecast. This is because these are ‘paper’ transactions only – there is no actual cash movement and therefore no impact on cash balances.

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.