Budget Monitoring Report

I want to compare actual spending to budget estimates...

What is it?

Accurate, timely and relevant Budget Monitoring Reports help provide project teams the information they need to:

- monitor project progress by comparing the budget with what actually happened during implementation. Remember, budgets are estimates and it is normal that things change and actual income and expenditure varies from these estimates when we begin implementing project activities. It is important to understand these differences and identify issues early on, so appropriate action can be taken to keep things on track

- promote accountability by demonstrating how project funds are used to those who have provided project resources and to the communities who are served by the project.

- ensure proper control of project funds by monitoring how financial resources are used, identifying variances from the plan and preventing errors and fraud.

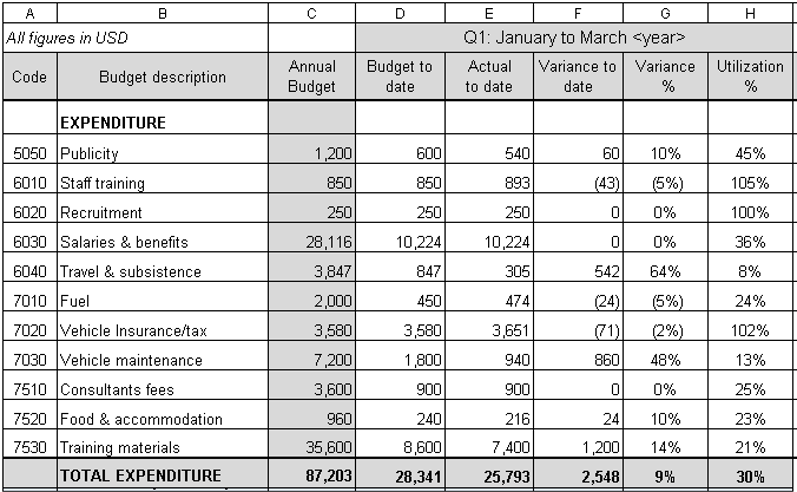

The report often uses the phased budget for the period (see ‘budget to date; in tale below) and compares it to the actual income and expenditure for the same period (see ‘actual to date’ in table below).

Sometimes budget monitoring reports show how much of the total budget for the year has been spent, this is called the utilization ratio or burn rate.

The table below provides an example of an illustrative Budget Monitoring Report:

Notice that for most line items there is a difference between the budgeted amount for the period and the actual expenses incurred to date. This is called the variance to date. It is important to understand why these variances have happened and to monitor larger variances closely to manage risks that could evolve into serious issues.

How do I use it?

The following scenario from UNITAS explains how the budget monitoring report is used in its Capacity Building Project.

Amira from UNITAS needs a budget monitoring report for the project’s first quarter (January to March). She sets up a meeting with her team at the end of March, asking the finance team to provide the actual income and expenditure for each of the activity areas for the project.

Amira first enters the budget for the whole year into her budget monitoring report. She then enters the budget for the first quarter from her phased budget.

Next, the actual income and expenditure data for January to March is entered into the actual to date column of the report template. The team can now compare the actual income and expenses to what was budgeted for the first quarter.

As the UNITAS team completes the template, they identify differences (variances) between the original planned expenditure and what has actually been spent. They can see whether budget lines are overspent or underspent.

As she works with her team, Amira acknowledges that there are several variances that need to be investigated and understood. She discusses the reasons for the variances with her team and if they present a concern or not. For example:

- Training fee income is less than the budget – This is because several training courses that were planned for the first quarter have been rescheduled for the second quarter (April to June). She isn’t too concerned about the variance on training fee income, because the planned income will come in the next quarter and the actual income will catch up with the budget.

- Training supplies expenditure is more than the budget to date (overspent) – Despite the fact that the training courses have been delayed, the training supplies line item is overspent. The team member responsible for training activities reassures Amira the reason for this is that the six months’ training materials have been purchased in bulk from suppliers, to get a special price. But the materials have not yet been used and are stored in a warehouse. They will be used by the end of the next quarter. Amira now understands why this budget is overspent and it will be resolved next quarter when the variance will disappear because no more training material costs will be incurred).

- Fuel expenses are more than the budget (overspent) – While the team had good explanations for the variances on the other two budget lines, no-one is quite sure why the fuel expenses is overspent compared to the budget. They agree to explore this further with the driver to see if the vehicle has been using too much fuel and needs to go to the workshop or if the price of fuel is more than they had estimated in their budget. These reasons may mean that the budget for fuel needs to be increased. Another possibility is there has been an error in coding expenses to this budget line or the vehicle may have been misused or fuel stolen. Amira and her team will explore this variance and meet in a week to take appropriate action.

When do I use it?

Budget monitoring reports should be produced and reviewed regularly (monthly or quarterly), so you must discuss with your finance team when the information will be available and who will produce the report. As a project team member you need to plan time in your calendar to review the information provided by the reports. You will need to give explanations for the variances to the project manager and note actions to be taken.

Who is involved?

Budget monitoring reports are usually produced by the finance team. The Project Manager is usually responsible to review them and produce notes on reasons for variances and agreed actions. The review process needs to involve the entire project team and may require active involvement of the finance team to provide timely data and details of transactions.

Tips:

As you review budget monitoring reports, keep the following checklist in mind:

- Check total expenditure

- Check total income

- Look at sub-totals for ‘family groups’, for example staff costs

- Look for unusual or unexpected results

- Look for significant variances in line items

- Check for consistent results across linked line items

- Refer to any supporting narrative reports – the story should be consistent

Supported & Developed by:

Shared by:

Users are free to copy/redistribute and adapt/transform

for non-commercial purposes.

© 2022 All rights reserved.

.

.